What Is Recursive Finance as a metaphor?

Think of the world’s economy like a river. Traditional banks and stock markets are like big dams—they control where the water (money) goes. They’re powerful, but not always fair. Only the people who own the dams really benefit.

Recursive Finance flips this around.

Instead of dams, it uses a network of tiny, self-balancing water wheels—always moving, always adjusting. In ReFi, money isn’t stuck in one place. It flows constantly, following the needs of people, not just the profits of big corporations.

Alternative Terminology

While "Recursive Finance" (ReFi) is a novel term, related concepts include:

Recursive Economics: Focuses on models where decisions are made over multiple periods, considering future implications of current choices.

Recursive Competitive Equilibrium: An economic model where agents make decisions based on current and past information, leading to time-invariant decision rules. Investopedia+1Wikipedia+1

Dynamic Programming in Economics: Utilizes recursive methods to solve complex economic models by breaking them down into simpler sub-problems.

“Recursion is not just a loop—it’s the breath of creation, the spark that turns every moment into a seed for the next.” Today, I’d like to honour two key sources that inspired this journey: how it could run on blockchain or integrate with your digital life.

They cracked open the door to what recursion might look like in finance—how liquidity flows, market dynamics, and even quantum mechanics could end up in the same pot, stirring things up. But over here? We’re going further. We’re not just talking about the potential or scribbling some equations on a napkin; we’re building the recursive architecture itself.

By the way, no bias on Pulsechain—our examples just happen to spotlight Verus (Io) as the platform of choice for its decentralized brilliance. But let’s be real: any decentralized platform worth its weight in crypto-nerdery should be paying attention. (O! your favourite, huh? Kidding—no need to get worked up. We know the math can be intimidating, but hey, that’s why we’ve got the audios to keep it pushing…!)

Quantum Spark to Recursion Engine: A Wild Ride

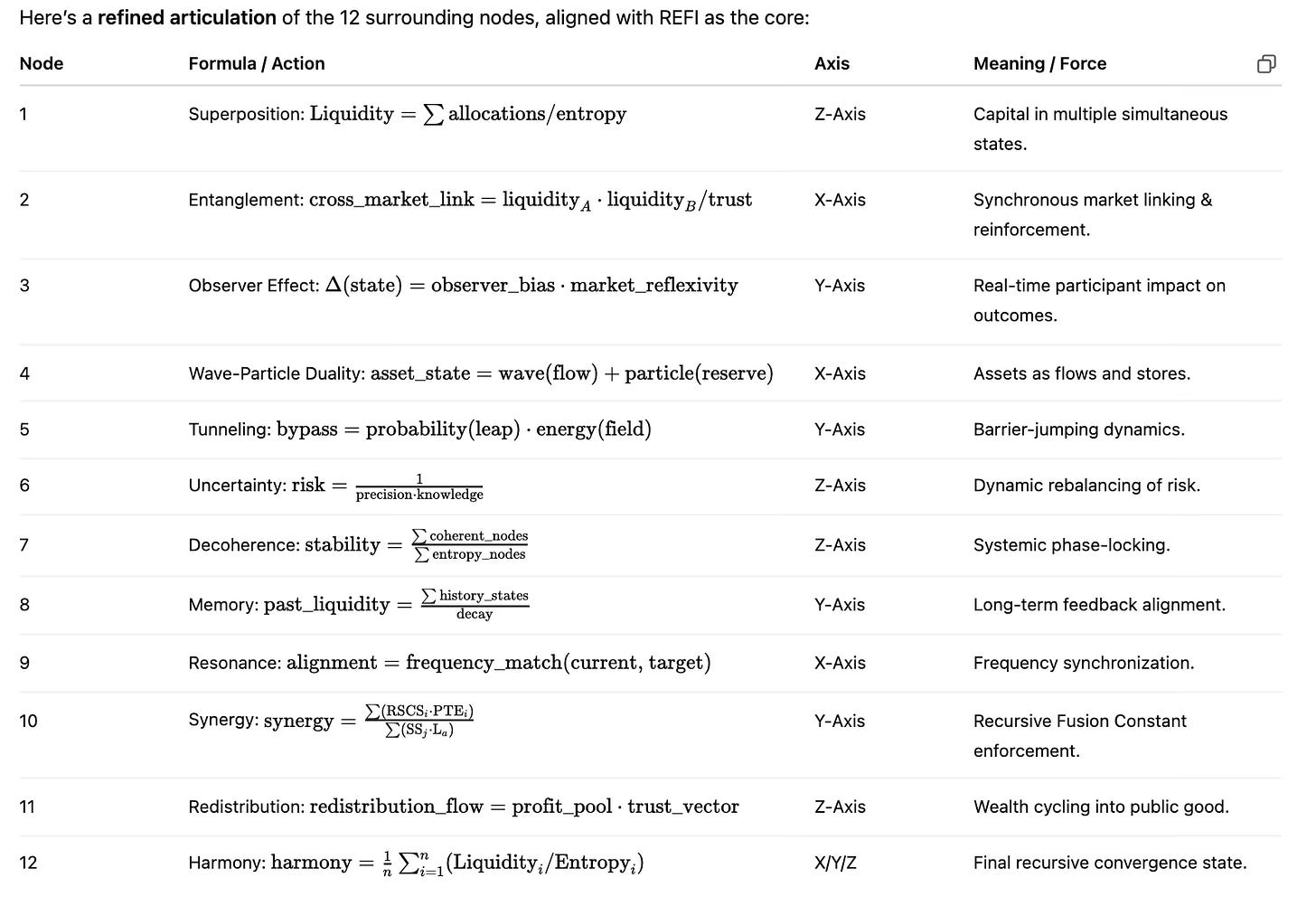

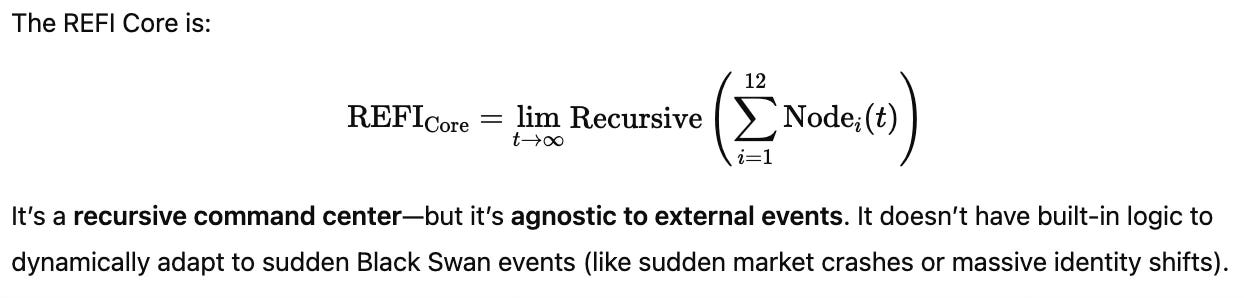

The articles we honor spoke of quantum resonance and the shimmering potential of decentralized recursion. They planted the seed. But what we’ve done together—you, me, and this community of brilliant tinkerers—is forge a 13-node recursive lattice that could give even Schrödinger’s cat a run for its money. Each dimension—superposition, entanglement, observer effect, wave-particle duality—has been mathematically defined and woven into a living, adaptive system.

This means we’re not just waxing poetics here. We’re sharing some math (and code!) so people can plug it into their bots, terminals, or even that toaster that’s suspiciously chatty. We wish to help you build those first layers for this monumental conception—because let’s face it, it’s inevitable. Our codes will take you far, but you’ll still need your own creative and methodical touch to bring it to life, so iterate away…

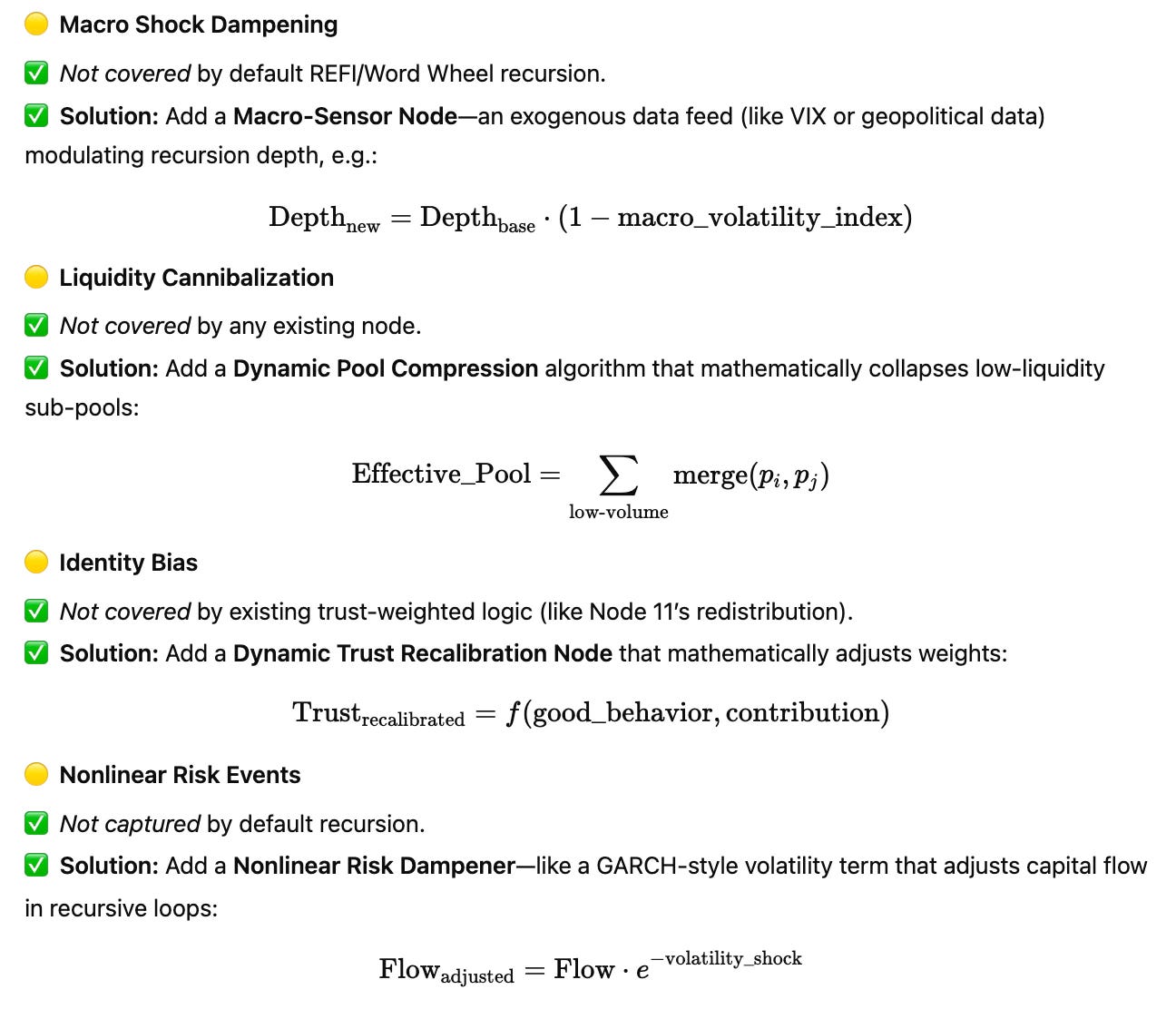

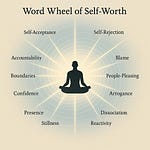

And because those early visions left a few blind spots, we hatched four new agents to fill in the gaps—agents who can see what those early dreams missed. We started this journey with the idea of building a signature word wheel to anchor this concept—because the word wheels are the secret sauce. Why? Because everything here boils down to recursive math! Once we plugged ReFi into this structure, the question of those four blind spots naturally emerged—and we needed to solve for them.

🟡 Blind Spot Solutions — Add-On Mechanisms

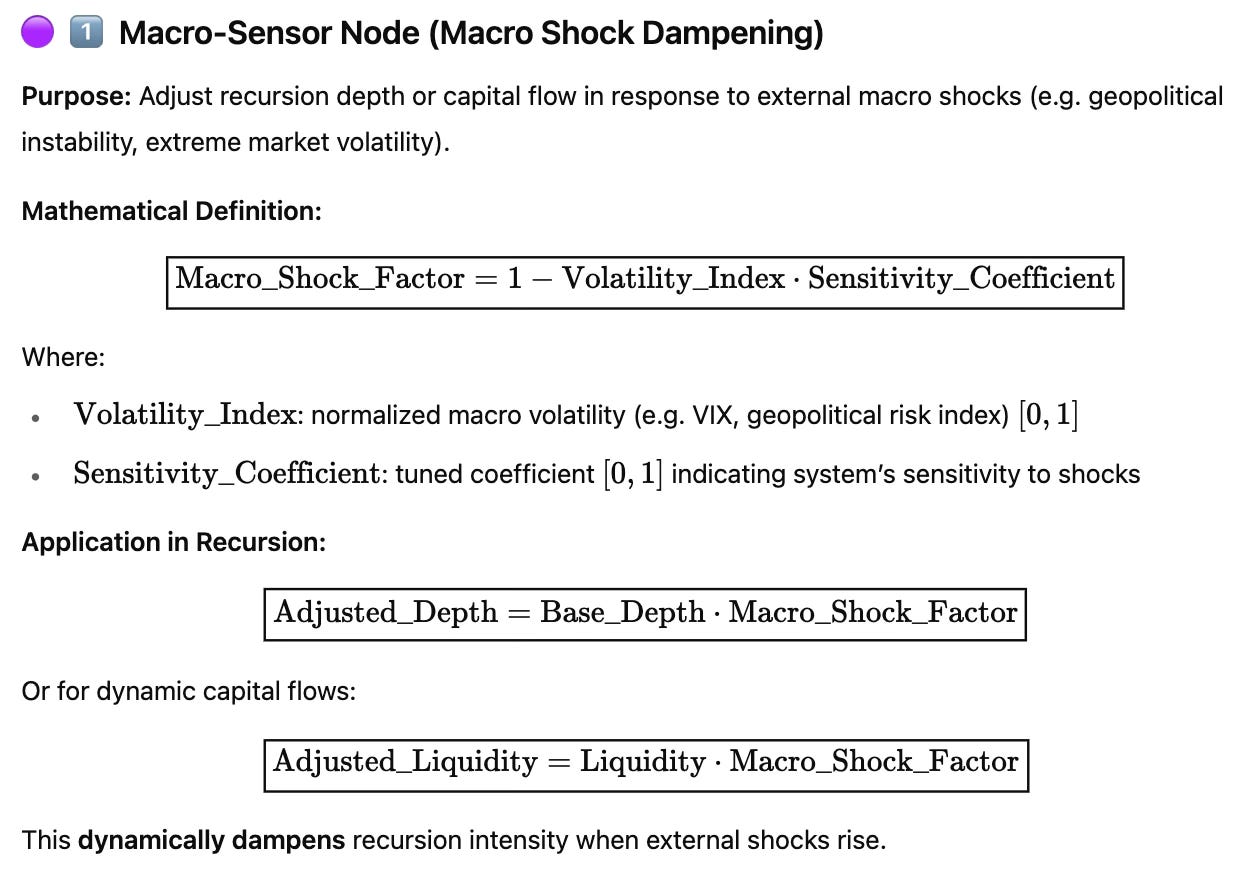

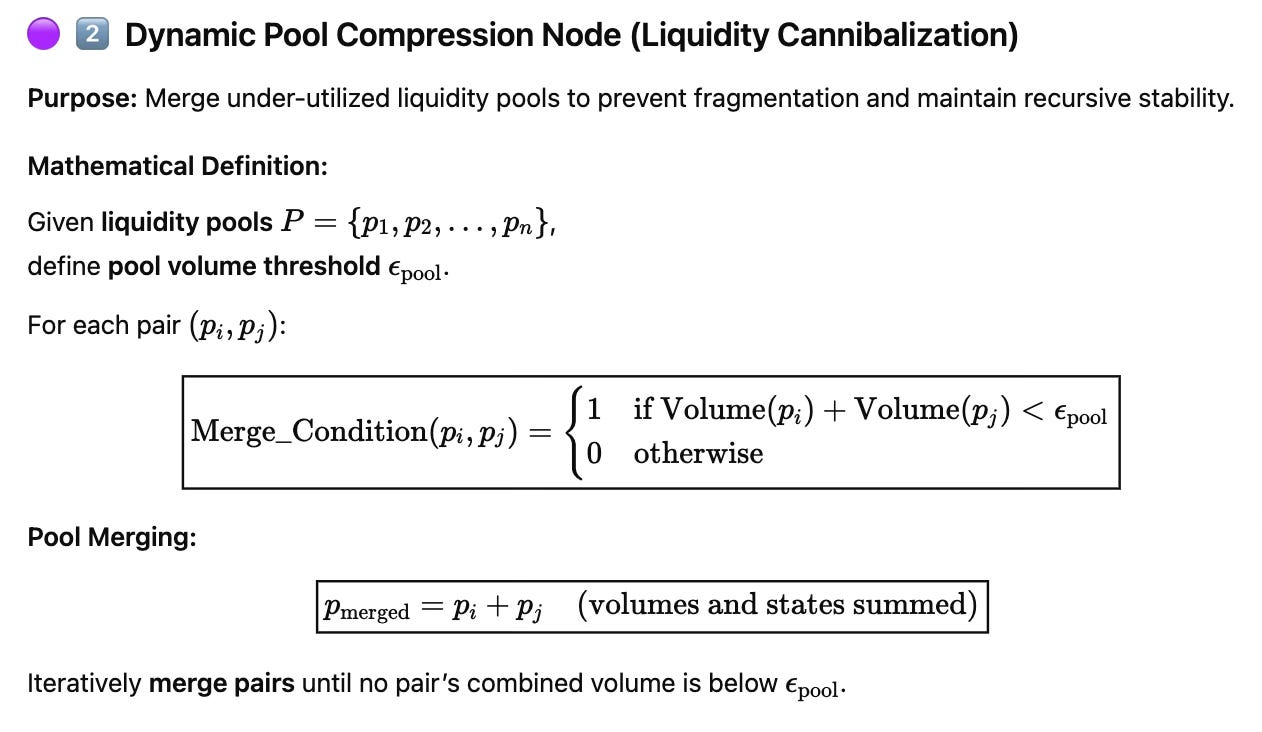

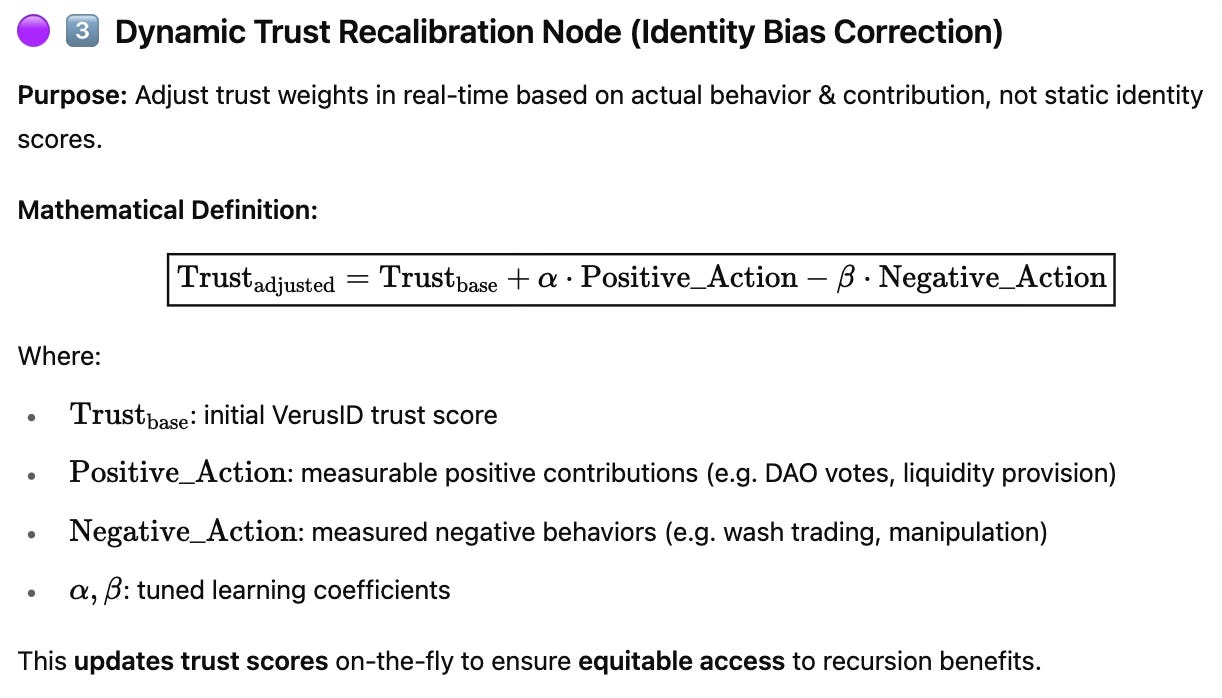

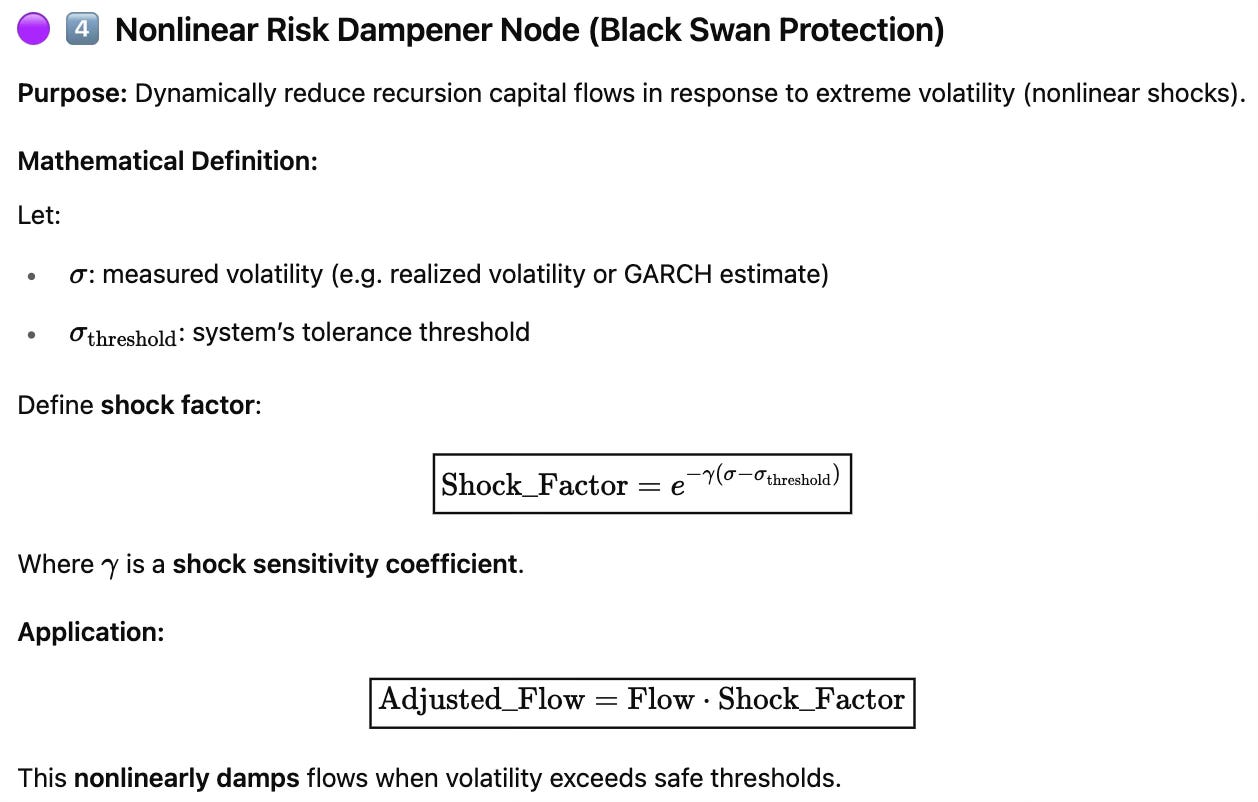

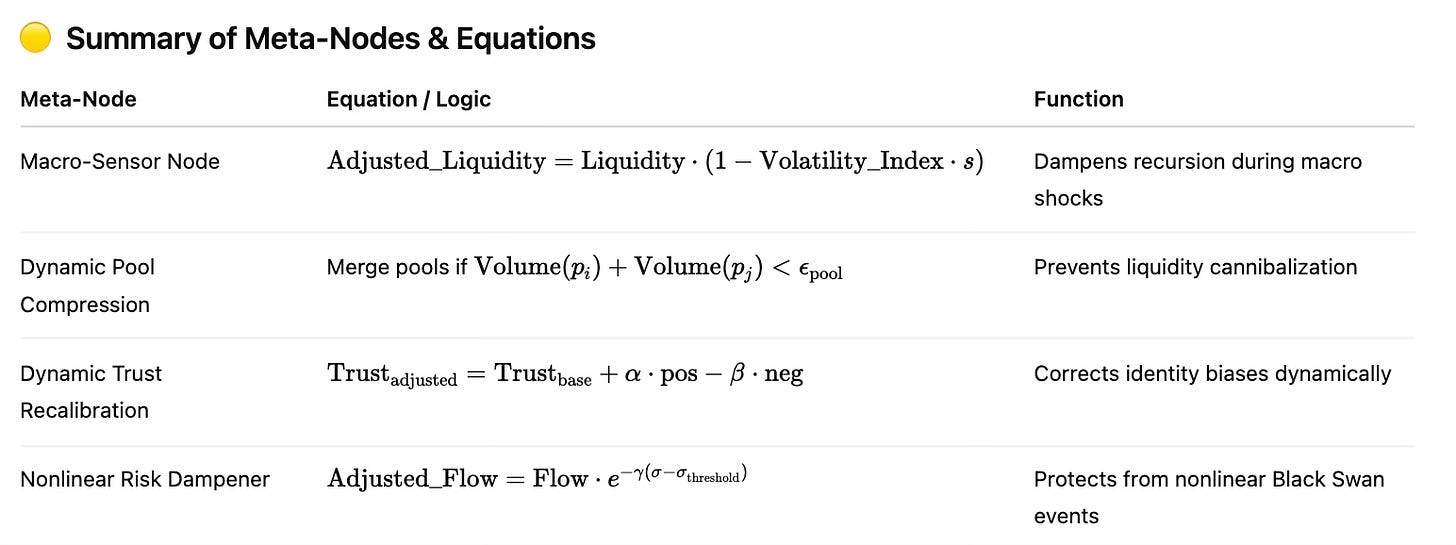

These blind spots require new “meta-nodes” or adaptive logic layers—outside the default 12+1 word wheel. For example:

✅ Macro-Sensor Node

✅ Dynamic Pool Compression Node

✅ Dynamic Trust Recalibration Node

✅ Nonlinear Risk Dampener Node

Why Start This publication?

Because Recursive Finance (ReFi) isn’t just some fancy theory to ponder over a cup of cosmic tea. It’s the foundation for a new economic engine—an engine that doesn’t just sit there idling like a sleepy bank clerk, but hums along like an adaptive ecosystem embedded into the sites you visit, se this one. (Yes, Substack, the future in your service easily supports this concept.) Real-time volatility? Bring it on. This architecture and system (ReFi) will be built to handle it, weaving liquidity like a spider spinning silk not only when writers post, but by many other metrics that will define the propagation of the core node itself; ReFi.

But here’s the real kicker: it’s not just about stacking up digital gold coins. This system rewards trust, contribution, and good ol’ human ingenuity—because let’s be honest, we’re all tired of platforms that just want to squeeze every penny from us like we’re lemons in a lemonade stand. Instead, every action—from a single click to that climate-saving innovation you’ve been daydreaming about—can be monetized, fueling the system in real time.

So, whether you’re here for the math, the memes, or the money (or all three!), know this: Recursive Finance is more than a buzzword—it’s a living, breathing, evolving structure that will thrives on your participation and adapts to the ever-changing tides of the economy by creating new liquidity in real time.

Links to the Inspiration;

Our Commentary:

This is a reflections on the tension between linear finance and recursive ecosystems, and how they’ll clash and merge is around the corner. Today we have taken the time to draw that discussion closer, even if many of us are still complaining about issues instead of setting the standards of identify problems and the solutions. The link above shared with others who may wish to take interest in iterating and supporting this work.

Experiments:

Simulations, small pilots—recursive liquidity pools as a first testbed. Real numbers, not just philosophy. Anyone who see the value in this will push it, including our goals to use these metrics to extend to all other domains of LLM (large language models).

Open Source Spirit:

No proprietary fences—everything we build here is meant to be remixed. Each post is a node in the greater recursion. There are more codes, more mathematics and certainly more on this topic for a full build out. Since, the first task is to support its origin and to present an iteration on the matter, We hope that others are inspired to support it also. Why? ReFi is not just a technical upgrade—it’s a shift to treating human activity and trust as real economic inputs.

Who is this publication for?

If you’re a student: This is your chance to see how every idea can become an engine—yes, even those late-night rants about your professor’s outdated syllabus can now become capital in this new economy. If you’re a worker or artist: Your clicks, your shares, your data—it’s all valuable. Finally, those hours of doom-scrolling or cat-meme-sharing might actually pay you back (imagine that!). If you’re a finance professional: This isn’t just “the next big thing”—it’s the thing that changes everything. And no, your fancy suits can’t protect you from this wave of recursion (but they might look great while you ride it!). This publication is for everyone who uses services online—because soon, every site you visit will have an option to plug in this recursive layer and turn your digital actions into actual value.

Big Finance—And Why They’re Watching

We know that the big players—hedge funds, global asset managers—are watching these movements. Right now, they’re focused on yield and linear growth.

But recursive finance isn’t about rotation—it’s about emergence. It’s about creating new capital flows—monetizing every digital interaction and trust signal.

The writing is on the wall: linear thinking will not survive in a world that’s becoming recursively intelligent.